A year ago I added the Chime Rewards Card to my wallet. I’ve saved at least $100 by using it throughout 2015 on purchases I probably was already going to do even without the reward.

Let’s break down how the card works and why you might be able to benefit from it!

1.) Say Goodbye to Unnecessary Fees

So first off, this card has no fees. It boasts some impressive features:

- No monthly fees

- No minimum balances

- No overdraft fees

- Access over 24,000 fee-free MoneyPass ATMs

I have never paid a fee with this card and my balance hovers between $0 and $100.

2.) Automatic Cashback and Rewards

You can check their site or check their app at anytime to see what rewards you have access to. I’ve seen/used a lot of decent deals. This month I’ve gotten:

- $2 off any Amazon Purchase

- $2 off $5+ Lyft/Uber Purchase

- $5 Off Netflix bill if payed with Chime

- $1 Off any Burger King purchase

They have 10+ offers up right now and they have regularly have some reoccurring ones plus add new ones all the time. You can save when shopping at Express, Best Buy, Olive Garden, Carrabba’s , Subway, Netflix, AT&T, Panera Bread, Walmart, J. Crew.

Whats great about the rewards is most have no minimum purchase or a very low purchase requirement. Here is a snapshot of some rewards:

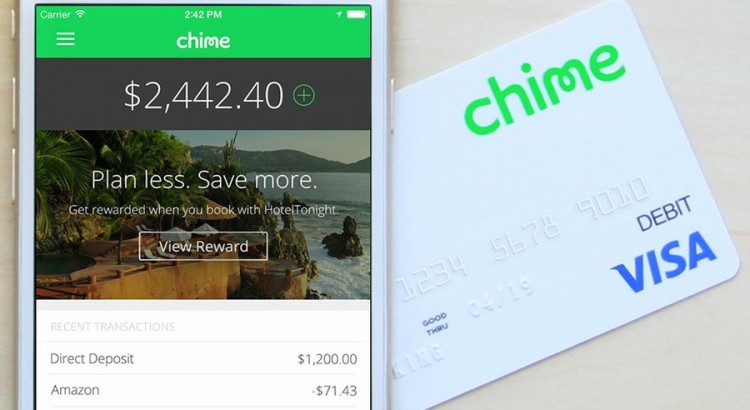

3.) Chime App

Their app is pretty awesome. When I make a purchase that qualifies for cashback, my phone buzzes with an alert saying how much cashback I get instantly, usually before they even hand my card back to me at checkout. Some other awesome features are:

- Ability to turn off card at anytime in case you no longer use it or lost it

- Map with fee-free ATMs, 24,000+ of them!

- Easily deposit money fee-free into from your bank

- See all rewards in your area

4.) Safely Use Card for Online Purchases

Chime is great for making purchases online where you want to secure yourself. If you have $5 in your Chime Account, make a purchase for $5, and the seller tries charging you a reoccurring fee, it wont go through. It will get denied and you will get alerted. No overdraft fee or anything like that.

- Instantly Alerts you of purchases

- Can toggle your card on/off, in case you lose it and then find it all from the app

- Will never overdraft, they will deny any payments over your balance, fee-free

To wrap up, this has been my favorite prepaid debit card I’ve had. The small rewards every month are great and I use it for a lot of online purchases for trials and things like that. Anything that I just don’t want to use my main bank’s debit card with. My chime card review would be short and sweet, it’s a great card for the rewards, security features, and no fees.

Let me know if you have a Chime card or know of anything else like this. I’ve been looking and haven’t seen any other reward debit cards like this yet.

Thank you for reading!